The Bangladesh entrepreneurship ecosystem: the next step /

What are the biggest problems that Startups and SME are facing in Bangladesh right now? And how can they be overcome – especially in times of COVID-19? Our programme partners Bijon Islam and Mehad ul Haque from LightCastle Partners share their insights into the entrepreneurship scene and illustrate how collaborative efforts such as B-Briddhi can support a thriving ecosystem for impact and growth.

Bangladesh has had remarkable growth over the last decade. The country nestled geo-strategically between India on one side, and China on the other, has performed with a GDP delta of +VE: 5 to 8%. A lot of the growth can be attributed to our twin engines – RMG/Textile growth (which explains 80%+ of our export mostly to Europe and the US) and remittances (from our human capital mainly positioned in the Middle East). Coupled with them, is the boom in ICT export (locally developed software and ITES export to more than 50 countries), a growing local consumer market (growing technology adaptable middle-income population) and large infrastructure projects (mostly in power, roads, bridges and mass transits, both public and private).

However, as we move into the next decade – Bangladesh also needs to focus on Startups and emerging companies, especially SMEs. A cursory glance at the advanced economies (like the US) or Bangladesh’s two powerful neighbours (India and China) confirms the hypothesis. Bangalore alone has lubricated India’s move to become an IT outsourcing giant (companies like TCS, Infosys, Wipro have gone global big time) and China (no need to elaborate) have only recently come down from its double-digit GDP growth. Alibaba, a pioneer in leading the technology revolution in China, has become the world’s most valuable B2B e-commerce company and has diversified their portfolios from retail, entertainment, cloud, and internet services to FinTech.

So, what’s holding Bangladesh back? There is an acute problem with Startups and SMEs (arguably the most potent engine for growth) on three levels.

Problem 1: The faltering infrastructure and investment initiatives for Startups/SMEs

The first problem identified is the faltering infrastructure and investment initiatives for Startups/SMEs. Almost all of the accelerators, incubation, and mentorship programs are located in the capital – leaving no support for startups from other cities. Adding on it, the dearth of access to finance (60+ banks and 34 NBFIs – mostly debt-based financial instruments with high-interest rates against collaterals) is a no-winner for entrepreneurs.

For tackling these challenges, initiatives need to be taken to circumvent Startups/emerging companies’ capital needs via Angel Investment Networks, Venture Capitals, and Private Equity Hedge Funds. The establishment of a vibrant equity capital market will attract the fund providers for profitable exits.

The good news is that a growing number of local and global entities have shown interest in the Bangladesh ecosystem lately. These range from international investment companies/global companies like, Gojek, an Indonesian decacorn, who invested in the local ride-sharing company, Pathao; Ant Financials, a fintech affiliate of Alibaba Group, who invested in bKash or IFC who invested in Chaldal; and local players – both alternative investment companies under B-SEC guidelines like, BD Venture and corporates like, Epilliyon and Urmi.

Angel syndicates like the Bangladesh Angels and the angel network have 50+ angel members. These types of networks are new, growing, and need to be more inclusive and be present throughout the entire country. In 2018, Bangladesh-based Startups raised U$ 27 Mn compared to U$ 4.2 Bn in India. Even considering the difference in economies (India’s GDP is ten times as of Bangladesh’s), the disproportionate gap of 155X in investment raises questions. Given the amount of risk capital the country needs to take the sector forward, the startups and SMEs also need to grow significantly to garner early investors’ interest.

Problem 2: The business environment is far from being competitive with comparable economies

Secondly, the business environment is far from being competitive with comparable economies. The inefficiencies in the market are at monumental amount. “Speed money” is required everywhere, and the existing players create entry barriers by virtue of “lobbying” and “muscle power”. Moreover, payment terms are equally bad, and often growing businesses already burdened by high financial costs die down because of the cash flow crunch. According to the World Bank’s Ease of Doing Business Index – Bangladesh ranks at 168 out of 190 countries with a score of just 45 out of 100. The country is reported uncompetitive on all vital components, such as Starting a Business (ranked 131), Getting Credit (ranked 119), Taxes (ranked 151), International Trade (ranked 176), and Enforcing contracts (ranked 189).

For the country to progress in the next decade, business processes, policies, and regulations have to be more streamlined and more comfortable to start and operate startups/SMEs. One way forward could be to use technology and fintech platforms to register and collect taxes from companies to make it more transparent and secure.

Problem 3: Lack of access to quality talent in the local market

Third and finally, access to quality talent in the local market is a massive challenge for the business ecosystem as a whole, especially more so for Startups and SMEs. While there are many (53) public, (90) private, and (2) international registered universities in the country, the industry-academia disconnect means there is an absence of the right kind of resources for the market. Moreover, fundamentally universities in Bangladesh do not yet focus on developing entrepreneurial talent – nor do they have the right sort of incubation programs, access to funding, or R&D labs to facilitate Startup/SME growth.

Without the right kind of talent – Startups and SMEs will always be a small segment and won’t be able to scale into large enterprises. Countries like South Korea have grown into major technology hubs with government incentives that tackled brain-drain and also brought back their intellectuals from innovation economies like the US – most of whom formed companies in the country or joined universities like KAIST (Korean Advanced Institute of Science and Technology). Even India receives huge knowledge remittances from NRIs (Non-resident Indians).

For Bangladesh to move forward, industry-academia is mandatory to set up the right kind of infrastructure to nurture innovation and talents at school/university level as well as leverage knowledge remittances from all over the world through incentivized initiatives.

What does the Startup ecosystem say for itself?

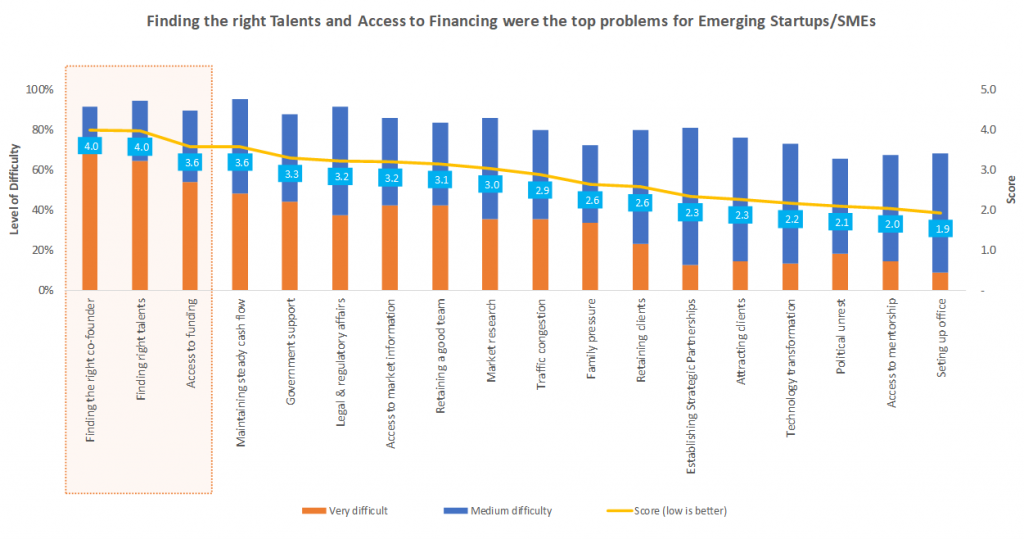

Recently, an internal survey on 100+ Startup company founders was carried out to understand what are the severe bottlenecks they are facing in operating a business in Bangladesh. The findings show the top three problems for the startup founders were related to either finding the right talent (co-founder and team- top 2 challenge each with a score of 4/5) and access to funding (3.6/5) followed by cash flow management (3.6/5), government support (3.3/5), and legal/regulatory affairs (3.2/5):

Global recession – the wrath of the COVID 19 pandemic

Since the end of 2019, the world is experiencing a “Black Swan” event – the COVID 19 pandemic. As an export-driven country, this will create a lasting impact on the country’s export sectors, especially- RMG sector, which is facing U$ 1.7 Bn worth of cancelled orders amid backward linkage disruption resulting in a million job loss; and foreign earning remittance, as other countries are shutting down, our human capital of half a million people have come back into the country from Middle-East and Europe where they were employed mostly in semi-skilled/unskilled category. Domestic demand not only in tourism but also for both services and products has scaled-down, leading to shutting down businesses and creating unemployment, especially in the informal sectors.

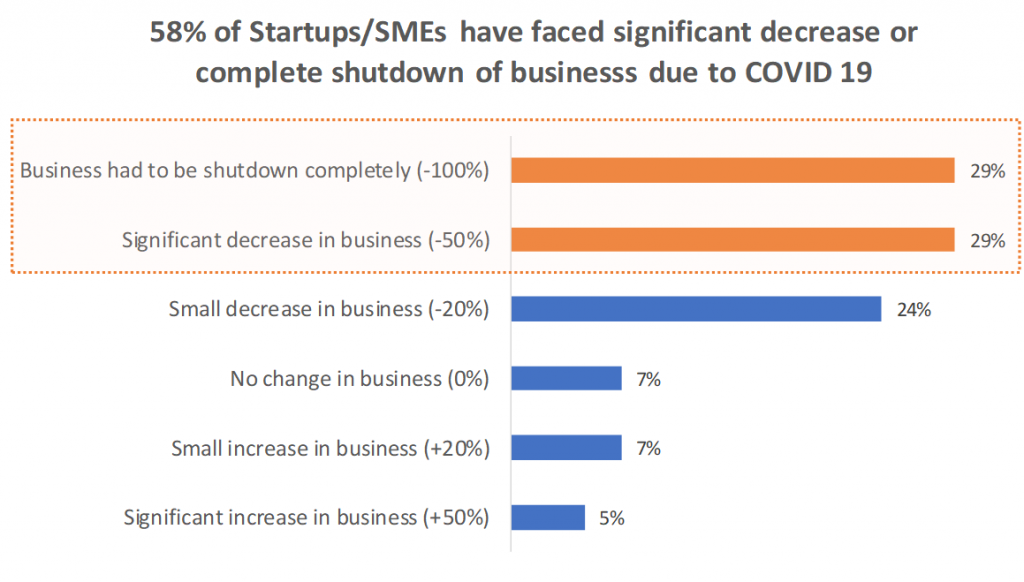

Given this scenario, businesses need to become increasingly inclusive and start creating social and environmental returns on top of positive economics, and the role of Startups/SMEs would become even more critical for equitable growth. A quick survey of founders during this testing time also shows that there has been a significant fall in their business activities – 29% reported a decline in business activities by more than half while another 29% reported a complete business closure. ADB estimates Bangladesh may lose up to U$ 3 Bn – 1% of its GDP for the Fiscal Year 2020-21, which may result in a job loss for 9 million people due to this pandemic.

Most of countries have come up with economic stimulus packages, and the Government of Bangladesh has declared the same. However, Bangladesh’s package covers only the export-oriented industries such as ICT/RMG/Textile sector (mandated that the 2019 export portfolio has to be more than 80%) in the form of refinancing from the Central Bank (to the amount of ~U$ 600 Mn) to pay wages and salaries. However, the SMEs/Startups have not been included in the stimulus package, and it is imperative to include and support this sector that contributes 20% of the country’s GDP and employs 35% of the total employment in Bangladesh.

Way forward

As we move forward, we need to support the Startup/SME and impact enterprise engine through a collective ecosystem play. Startups need the right drive, motivation, mentorship, business environment, and access to funding networks.

The sector can reach optimum growth by building an ecosystem via cross-collaboration with the government, angel investment networks, institutional investors, ecosystem builders, development partners, trade chambers, and of course, the budding Startups, whether traditional or impact-focused, is of utmost priority.