Driving Inclusion through Embedded Finance: Lessons from Sheba and ShopUp

The third edition of Biniyog Briddhi’s Peer-to-Peer Exchange Event occurred on November 13th, 2024, uniting trailblazers in Bangladesh’s impact entrepreneurship ecosystem for an engaging session titled “Embedded Finance: Learn from Sheba and ShopUp.” Despite overall improvements in recent years, financial inclusion remains a significant challenge for underserved populations in Bangladesh, with 47% of adults still considered unbanked as of 2021 (Global Findex Index, 2021). With their innovative business models, impact entrepreneurs like Sheba and ShopUp are uniquely poised to help drive financial inclusion, and the Event offered insights into how embedded financial services can specifically further this aim.

Featuring Adnan Imtiaz Halim, Co-Founder and CEO of Sheba.xyz, Shaheen Siam, Co-Founder and CSO of ShopUp, and moderated by Bijon Islam, CEO of LightCastle Partners, the Event provided a comprehensive window into how these enterprises embed financial products into their platforms to drive revenue growth, build customer trust, and catalyse social impact.

Sheba.xyz: Empowering Micro-Entrepreneurs through Embedded Finance

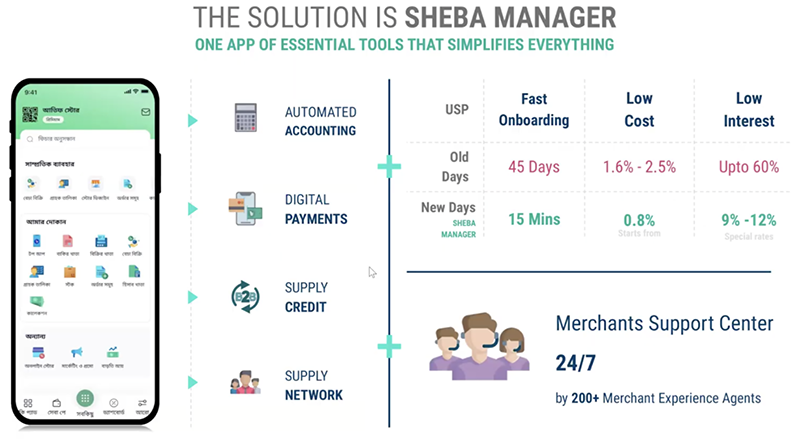

Adnan began by recounting Sheba’s journey from its inception as a digital service marketplace to its current role as an MSME-focused platform addressing their unique needs. “Sheba Manager” (sManager for short), their flagship app, became the cornerstone of this transformation.

“Out of 10 million businesses in Bangladesh, we aim to empower the top 50%, creating 20 million jobs and improving lives for 120 million people reliant on MSMEs,” Adnan emphasised.

Zooming out, Sheba’s MSME support has enabled the development of an integrated ecosystem that includes four core solutions:

- Sheba.xyz: A consumer-facing lifestyle platform that broadens market access for service-based businesses.

- Sheba Manager: A business management tool designed for small merchants, enabling them to manage transactions, build credit histories, and access financing.

- Sheba Pay: A seamless payment platform that helps businesses process transactions efficiently.

- Enterprise Solutions: A unit dedicated to sourcing supplies for merchants, and streamlining operations for small businesses.

These solutions collectively address the critical gaps faced by MSMEs, including operational inefficiencies, limited access to credit, and a lack of trust in formal systems. Adnan highlighted that the key to Sheba’s success has been its ability to adapt to the challenges faced by merchants. By partnering with financial institutions, Sheba has created a system where data from Sheba Manager is used to de-risk small-ticket loans. This collaboration has unlocked financing opportunities for thousands of small businesses, enhancing financial inclusion, driving job creation and improving livelihoods.

“We’ve shown that financial tools can be transformative, not just for individual merchants but for the broader economy,” Adnan added.

sManager’s flow of operations, shared by Adnan from Sheba’s pitch deck

ShopUp: Transforming MSMEs with Embedded Finance

Shaheen Siam of ShopUp shared a similar vision to supporting MSMEs albeit with a distinct approach. ShopUp’s platform addresses critical MSME pain points, such as inventory shortages, logistics challenges, and financing gaps, through end-to-end solutions. “Many MSMEs operate in cash and rely on informal credit sources, which are both expensive and unreliable,” Siam noted.

Embedded finance is central to ShopUp’s strategy. By integrating financing options into their platform, ShopUp provides MSMEs with access to affordable credit, enabling them to grow their businesses sustainably. In doing so, MSMEs reduce their reliance on predatory lenders and regain trust in formal financial systems.

Siam outlined how ShopUp’s transactional data plays a pivotal role in assessing creditworthiness. By leveraging bank partnerships and data funnelling through their platform, ShopUp can offer tailored financial products that meet the unique needs of each merchant. This data-driven approach has allowed ShopUp to scale its credit solutions while maintaining low default rates.

“Our goal is to ensure that financing is no longer a barrier for MSMEs. With the right tools and support, these businesses can thrive and contribute to economic growth,” Siam explained.

Clockwise from left: Adnan Imtiaz Halim, Co-Founder & CEO of Sheba.xyz, Shaheen Siam, Co-Founder & CSO of ShopUp, and Bijon Islam, Co-Founder & CEO of LightCastle Partners

Overcoming Barriers to Embedded Finance

Both Adnan and Siam acknowledged that embedding financial products into their respective platforms was far from straightforward. They highlighted key challenges and strategies used to overcome barriers, including:

- Building Trust:

Many MSMEs are sceptical of formal financial systems due to limited understanding or negative prior experiences with predatory lenders. Sheba addressed this by creating localised support teams to educate merchants about loan terms and repayment plans in simple language. Similarly, ShopUp invested in building relationships with their users by providing transparent, easy-to-understand financial products. - Partnerships with Financial Institutions:

Both enterprises faced hurdles in collaborating with traditional financial institutions. Adnan noted that banks were initially hesitant to extend credit to small-ticket borrowers due to higher perceived risks. However, by leveraging transaction data to demonstrate the viability of these loans, Sheba was able to eventually secure buy-in from banking partners. Siam highlighted that ShopUp had to invest in educating financial institutions about the unique needs of MSMEs first before being able to develop partnerships needed to scale. - Operational Challenges:

Both enterprises faced initial challenges ensuring that their embedded finance solutions were seamlessly integrated into their tech stack. Overcoming this required significant investments in technology and data analytics, as well as ongoing iterations based on user feedback.

Future of Embedded Finance

Looking ahead, both Sheba and ShopUp have ambitious plans to scale their financial offerings. Adnan shared plans to introduce insurance and savings products tailored to the needs of MSMEs, further expanding Sheba’s range of solutions. Meanwhile, Siam emphasised the role of advanced analytics in improving credit decision-making, allowing ShopUp to offer more personalised financial solutions at scale.

The session closed with advice for other enterprises looking to integrate financial products into their business models:

- Start Small: Both Adnan and Siam recommended testing solutions with a limited audience before scaling.

- Listen to Customers: Understanding the unique needs and pain points of users is critical for designing effective solutions.

- Partner Wisely: Collaborations with financial institutions or fintech companies are essential, but alignment on vision and goals is key to success.

In sum, the Peer-to-Peer Exchange Event highlighted the transformative potential of embedded finance in fostering inclusive growth and driving social impact. Through innovation, collaboration, and a customer-centric approach, Sheba and ShopUp are addressing systemic challenges faced by MSMEs in Bangladesh. Their experiences offer valuable lessons for the broader impact entrepreneurship ecosystem, showcasing how technology and data-driven strategies can create meaningful change.

Watch the discussions and learn more about Sheba and ShopUp’s impact journey!

About the Biniyog Briddhi Programme:

B-Briddhi, is a gender-inclusive programme supporting a thriving impact ecosystem in #Bangladesh where impact enterprises can grow and scale. This programme is supported by #Switzerland and implemented by Roots of Impact and LightCastle Partners.